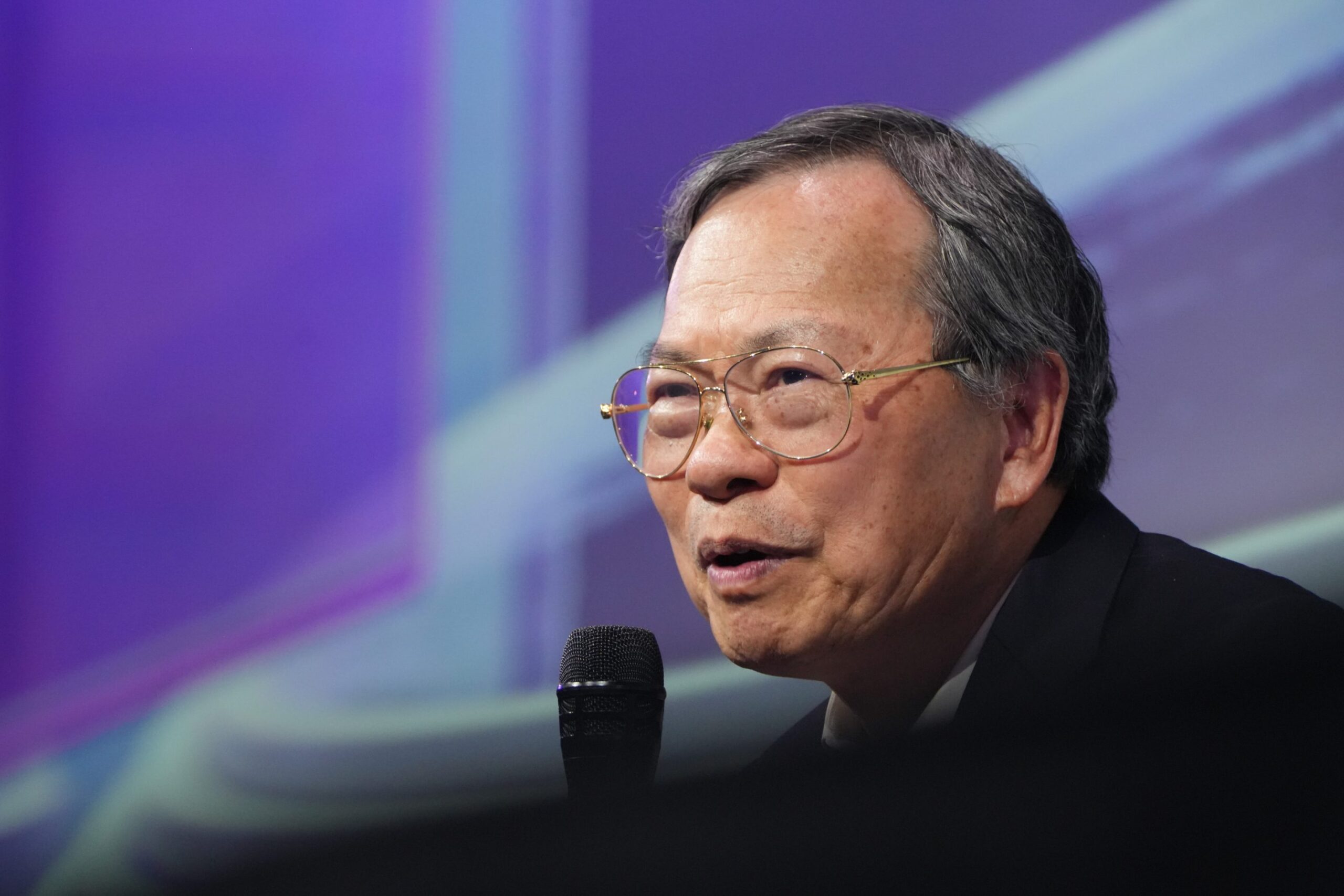

Supermicro Chairman and CEO Charles Liang triumphantly announced to investors in early December 2024 that a special investigation spurred by the abrupt resignation of audit firm Ernst & Young had found no evidence of fraud or misconduct. This declaration, made through a detailed SEC filing, aimed to reassure a market unnerved by the sudden departure of a major auditor and the subsequent scrutiny of the IT solutions provider’s financial practices. The company, a pivotal player in the burgeoning artificial intelligence infrastructure buildout, was eager to clear its name and restore investor confidence after a turbulent period.

However, the exoneration came with significant caveats. The investigation, conducted by an independent committee of the board, resulted in a series of pointed recommendations that Supermicro promptly agreed to implement. Among these was the immediate appointment of a Chief Accounting Officer (CAO) and the commencement of an "immediate" search for a new Chief Financial Officer (CFO) to replace David Weigand, who had held the CFO role since February 2021. While the committee explicitly stated that no wrongdoing was personally pinned on Weigand, its findings highlighted "lapses" in the company’s rehiring processes. Specifically, the report detailed the re-engagement of nine individuals who had previously resigned in 2018, following an entirely different audit-related investigation that had deeply impacted the company’s reputation and financial reporting. The committee’s findings unequivocally stated that Weigand, in his dual capacity as CFO and chief compliance officer, "had primary responsibility for the process of hiring these employees, [and therefore] he had primary responsibility for processes lapses."

Further compounding the issues, the investigation revealed that Supermicro had entered into a consulting arrangement with its former CFO—who had also resigned in connection with the 2017 investigation—without informing its then-auditor, Ernst & Young (EY), or the board’s audit committee. Such an oversight is a significant breach of corporate governance, raising questions about transparency, internal controls, and potential conflicts of interest. The lack of disclosure to both the external auditor and the internal oversight body suggests a breakdown in critical communication channels and a disregard for established protocols designed to safeguard financial integrity. EY’s resignation itself was a major red flag for investors, often indicating serious disagreements over financial reporting or internal controls that an auditor cannot reconcile.

Following these disclosures, Supermicro moved swiftly to address some of the recommendations, naming Kenneth Cheung as the CAO and principal accounting officer. This quick action was a positive signal regarding the company’s commitment to strengthening its accounting function. Yet, more than 14 months and four straight financial quarters later, David Weigand remarkably remains in the CFO seat. There has been no public update to investors regarding the progress of the CFO search in any public filings or investor communications throughout the year since the initial announcement. Weigand continued to participate in analyst calls, including the one for the company’s second-quarter 2026 earnings results this month, and signed off on regulatory documents, maintaining his official capacity. This prolonged interim period raises concerns about the company’s commitment to its own publicly stated recommendations and the underlying reasons for the delay.

The extended hunt for a new CFO underscores the ultra-competitive state of the market for hiring a strategic finance leader, especially one who brings extensive audit or accounting expertise, coupled with credibility on Wall Street. In the current economic climate, marked by increasing regulatory scrutiny and rapid technological shifts, the demand for highly qualified financial executives has surged. Given Supermicro’s high-profile role in the unprecedented AI buildout frenzy, the ideal CFO also needs to possess robust strategic relationships with analysts, investment banks, and key market participants. They must be able to articulate the company’s complex financial narrative and growth prospects convincingly to a discerning investor base.

Moreover, Supermicro’s specific corporate history has undoubtedly made this critical executive search all the more challenging. The company has contended with a slew of accounting-related allegations and reputational "smoke" over several years, which likely acts as a deterrent for top-tier candidates. Despite the company’s strong affiliation with high-flyer Nvidia and its surging market capitalization, the lingering shadow of past financial irregularities makes the CFO position a high-risk, high-reward proposition.

Shawn Cole, president and founding partner of executive search firm Cowen Partners, captured this sentiment succinctly, stating, "No one wants this job—this is like touching lightning." He elaborated that if something were to go wrong in such a role, it could be "poison" to someone’s career, making it an exceptionally difficult sell for potential candidates. Cole also pointed to the company’s "ambiguity" on the matter and the conspicuous lack of public updates through investor relations and corporate communications as a "red flag" in itself. Such silence could suggest potential discord between the CEO and the board, especially at a time when the talent pool for experienced CFOs is shrinking, allowing "top talent gets their pick," rather than companies dictating terms. "The price of a qualified CFO in that industry is extremely expensive, and they might not be in the best position to attract top talent," Cole added. "If they’ve been trying to initiate a CFO search, they’re probably experiencing some significant frustration in doing so."

In response to inquiries, Supermicro issued a statement that did not specifically address the CFO search directly. "Supermicro has undertaken a double-digit expansion of its staff globally, including the search for key Senior Executives to help the company accelerate its historic growth in the rapidly evolving AI market," the company stated in an email response, a generalized comment that sidesteps the specific concerns surrounding the CFO role.

Supermicro’s relationship with Nvidia is undeniably one of the key drivers to its prominent place in the AI ecosystem buildout. Founded in San Jose in 1993, Supermicro describes itself as a "Total IT Solutions" manufacturer, specializing in designing and building servers, storage systems, and data center infrastructure that power AI, often jam-packed with Nvidia’s highly coveted GPUs. One of their chief offerings is the Data Center Building Block Solution, a ready-to-deploy data center that eliminates the need for complex component assembly. Supermicro also holds proprietary liquid-cooling technology, crucial for managing the extreme heat generated by the latest AI chips. This Fortune 500 company is aiming for net sales of at least $40 billion this year, according to its most recent earnings call, and maintains strategic relationships with other industry giants like AMD, Broadcom, Intel, Samsung, and Micron, as detailed in its annual report.

The company has garnered significant accolades for its agility and capability, most notably for teaming up with Elon Musk to construct xAI’s massive 750,000 square-foot Colossus cluster in an astonishing 122 days. Charles Liang also counts Nvidia CEO Jensen Huang as a friend, underscoring the deep integration between the two companies. Supermicro works closely with Nvidia’s engineers to ensure its server systems are perfectly aligned with new GPUs, a strategy it refers to as "time-to-market" leadership. During its first quarter of 2026 call with analysts, Liang proudly announced that one of its Nvidia Blackwell product lines had generated $13 billion in orders, including the largest deal in the company’s 32-year history.

Despite this impressive growth trajectory and strategic importance, Supermicro has a history of battling significant corporate governance and accounting challenges. The company faced a trading suspension from the Nasdaq stock exchange in 2018 and a panel decision to delist its stock following a previous accounting investigation. It then faced the threat of another delisting following EY’s surprise resignation in 2024. In 2020, Supermicro paid a $17.5 million penalty to the SEC, and its former CFO, Howard Hideshima, paid a $350,000 fine and agreed to a cease-and-desist order. Charles Liang himself was not charged with misconduct but was required to reimburse the company $2.1 million in stock profits related to a clawback associated with alleged accounting errors, a rare and serious measure.

Four years later, around the same time EY quit, Supermicro was the subject of a short-seller report from famed firm Hindenburg Research, further exacerbating investor jitters. This period also saw delays in filing annual and quarterly reports, prompting Nasdaq to again threaten delisting. In response, Supermicro hired new accounting firm BDO USA and has since implemented a series of changes aimed at shoring up its governance and regaining compliance with Nasdaq listing standards. In March 2025, the company appointed Yitai Hu, formerly its senior vice president of corporate development, as General Counsel. The board also appointed Scott Angel, a veteran auditor who spent 25 years as a partner in Silicon Valley with Deloitte, as an independent director, a move specifically designed to enhance financial oversight. While the board did appoint a lead independent director in 2025 to serve as a counterbalance to Liang in his dual chairman and CEO role, this appointment ended just last month, suggesting a continuous evolution in its governance structure.

Yet, through all these changes and challenges, the critical CFO role remains unchanged.

A 2025 report from search firm Russell Reynolds, which tracked global CFO turnover, highlighted that experienced appointments hit a seven-year high last year, illustrating a clear preference for seasoned professionals over first-time candidates. Among S&P 500 companies, which have significant overlap with the Fortune 500, experienced hires jumped from 36% to 43% year-over-year. The report also found that only 16% of CFOs surveyed believed their companies had a meaningful succession plan in place for their eventual replacements, a factor that often widens the gap and complicates transitions.

Ross Woledge, head of the CFO practice at search firm Odgers, explained that a company like Supermicro is likely searching for a "pretty special mix" in its next CFO: someone with a strong corporate governance track record and financial gravitas who can reassure the market about the company’s financial rigor. Such a candidate needs to offer a "safe pair of hands" while simultaneously positioning the company for innovation and aggressive R&D investment. Woledge notes that it can be "tough" to find a single individual who excels in both these aspects.

"It’s a really fast-moving tech company that’s expanding at a pretty rapid clip," said Woledge. "The CFO needs to be a really great partner to the CEO to drive that—and that’s a different type of skill set." Unfortunately, most CFOs often lean one way or the other, he added, which has likely made Supermicro’s search more difficult. In Woledge’s experience, most boards prefer to wait for the ideal candidate rather than compromising on their top priorities. While some executive searches extend from six to 12 months, some run even longer, particularly if a board is holding out for extensive experience. Boards often conduct multiple rounds of interviews over several months to thoroughly vet candidates, further extending the process. It is often easier to find a CFO with a strong accounting or audit background than one who also possesses strong strategic relationships, capital markets expertise, and innovation experience.

"The risks are too high when you get a CFO search wrong," Woledge concluded. "And then factor in the situation around this, and it’s additionally important that they get this one right." Supermicro’s journey to solidify its financial leadership remains a critical subplot in its otherwise compelling narrative of AI-driven growth, with the market keenly watching for a definitive resolution.